If your corporation is going to do business in Missouri, but was formed in another state or jurisdiction, you’ll need to file an Application for Certificate of Authority with the Missouri Secretary of State, Corporations Division. Registering a foreign corporation in the Show Me state is a great way for business owners from any of the 8 border states or beyond to expand their business. It costs $155 to file the application, and processing times vary from 1 business day (if you file online) or 3-4 weeks (by mail).

Want an easy way to register your foreign corporation in Missouri? If you’re not one for complicated paperwork, hiring a professional service like Missouri Registered Agent LLC to register your Missouri foreign corporation makes the process very easy. For $100 plus the state’s filing fee, we’ll submit your application to the Missouri Secretary of State. All you have to do is sign up for our Out-of-State Registration Service.

If you want to take on the task yourself, we’ve written this guide for you! Below, we’ll walk you through everything you need to know to start doing business in Missouri.

- Choose a name for your foreign corporation

- Appoint a Missouri registered agent

- Get a Certificate of Good standing

- Register your foreign corporation in Missouri

- Get your Missouri Certificate of Authority

Register a Foreign Corporation in Missouri

It’s time for your corporation to expand and do business in Missouri. Now what? Your first step to doing business in the Show Me State is registering your company as a foreign corporation with the Missouri Secretary of State. You’ll do this by submitting an Application for Certificate of Authority For a Foreign For-Profit Corporation and paying the $155 filing fee. We highly recommend completing and filing your application online using the Missouri Online Business Filing System.

Why Missouri? It’s one of the least expensive states to maintain a corporation in. Corporations are still required to pay a corporate income tax, but in 2016 the state eliminated its corporate franchise tax, making it one of the few in the country that doesn’t charge corporations, domestic or foreign, an extra tax for doing business in the state. Corporations are also required to file a simple Annual Registration Report every year with a filing fee of only $20. (Compare this to Illinois’ $75 annual report filing fee or Kansas’ $55 fee!)

1. Choose a Name for Your Foreign Corporation

If you’re expanding your business, odds are you already have a name picked out for your foreign corporation. However, there’s a chance you won’t be able to use it for your business in Missouri. Before you begin your Certificate of Authority application, you’ll want to make sure another established business in Missouri isn’t already using your name. The state has made it easy to look up the names of current businesses with the Missouri Secretary of State Business Search.

If you find that another business is using the name you want, don’t worry! You’ll just have to pick another name in order to operate in the state. If you run into this roadblock, you’ll want to make sure the name you choose meets the state’s requirements (RSMo 355.146). Your foreign corporation’s name:

- Cannot be in use by another business entity operating in the state

- Must include one of these designations as is or abbreviated: Corporation, Company, Incorporated, or Limited

- Cannot include any language that implies that the corporation is a different type of entity, like an LLC or government office

Can I reserve a name for my foreign corporation?

Yes you can! If the name you want for your foreign corporation is available, but you’re not quite ready to file, the Missouri Secretary of State allows you to reserve a name to make sure it’s yours when you want it. All you need to do is file an Application for Reservation of Name to the Missouri Corporations Division and pay the form’s $25 filing fee. Once complete, your business name will be reserved for up to 180 days.

2. Appoint a Missouri Registered Agent

Missouri requires foreign corporations to appoint a Missouri registered agent. Unless the registered agent you appointed in your home state also resides in Missouri, you’ll need to make sure you appoint a different registered agent who does. This registered agent must:

- be 18 years or older

- have a physical address in Missouri

- be available to accept legal mail and service of process in person at their Missouri address during regular business hours

Unless you can meet the requirements above, you won’t be able to appoint yourself as the registered agent for your foreign corporation. Instead, you can appoint a Missourian you know or hire a professional registered agent service (like us!).

If a Missouri resident agrees to be your registered agent, keep in mind that once your foreign corporation is registered the information you provide on your application becomes public. If you or the agent you appointed is concerned with protecting their privacy, you may want to consider a professional service. For many business owners, hiring a professional registered agent is a good way to keep their private information just that–private.

Is a registered agent required in Missouri?

Absolutely. State law (RSMo 351.370) requires all business entities appoint and maintain a registered agent in Missouri. Companies that fail to do this can suffer pretty severe consequences, including having their foreign qualification revoked by the Secretary of State. Failure to appoint a registered agent can also lead to both the foreign corporation and its owners being charged with other penalties and fees.

3. Get a Certificate of Good Standing

After you’ve settled on a name for your foreign corporation, you’ll also need to get a Certificate of Good Standing from your home jurisdiction. A Certificate of Good Standing is a document you can order from your home state that proves your corporation is currently in good standing. If you do not get one of these certificates, your foreign corporation will not be able to do business in Missouri.

How to get a Certificate of Good Standing varies from state to state, but most likely you’ll be able to order one through the Secretary of State (or similar office) of your home jurisdiction. Not all states charge a fee for this, but some do. Make sure you check in with your state’s business filing agency to learn the specifics on how to order your certificate.

What if I can’t get a Certificate of Good Standing?

Frankly, if you can’t get a Certificate of Good Standing from your home state, it’s probably not a good time to register a foreign corporation. The most common reasons corporations can’t get a Certificate of Good Standing is because the company has not:

- officially registered as a business entity in its home jurisdiction

- filed the required reports (usually Annual Reports) with the state

- paid taxes (like corporate income or franchise taxes)

If any of this applies to your business, you’ll want to make sure you get your corporation back in compliance with its home jurisdiction. Every state’s process looks a little different, but checking in with the Secretary of State’s office is a good place to start. When your corporation meets state requirements, you’ll then be able to get your Certificate of Good Standing.

4. Register a Foreign Corporation with the Missouri Secretary of State

You’ve picked an available name for your foreign corporation and got your hands on a Certificate of Good Standing from your home state. Now it’s time to start your application! You have several options when it comes to filing an Application for a Certificate of Authority:

- Hire a company that specializes in registering foreign corporations in Missouri. When you hire us, we’ll simply ask you for the information we need to complete your application and take care of the filing for you.

- Mail in your application to the Missouri Secretary of State, Corporations Division and pay the $155 filing fee.

- Create a free business profile with the Missouri Secretary of State’s Online Business Filing portal. You’ll be able to complete, pay for, and submit your application online in your account.

If you complete the filing yourself, we recommend submitting your application online. It’s easier and much, much faster than mailing in your application.

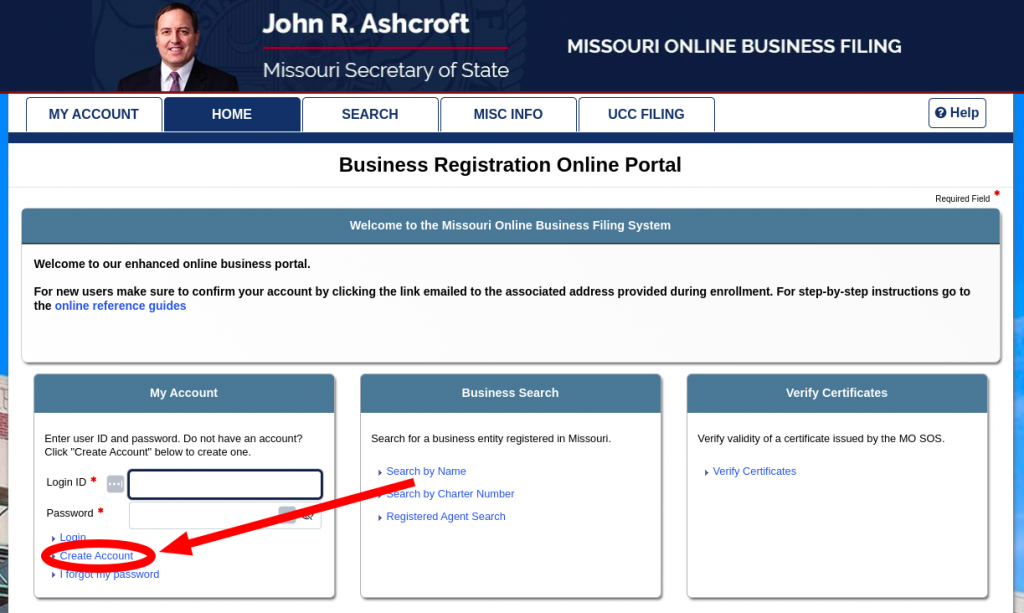

Create an Account with the Missouri Online Business Filing System

The first thing you’ll want to do is create a online account with the Missouri Secretary of State. Once you’re on this page, you’ll see a link that reads “Create Account” below the account login. Clicking this link will take you to the Online Account Creation form.

In order to create an account, you’ll need to provide a valid email address and some personal information like a user ID, password, answers to some security questions, and your contact information. Once complete, you’ll agree to the terms and conditions and voila! You will have created your business account with the Missouri Secretary of State.

It’s important to note that your account information will not be included on your state paperwork.

Complete Application for Registration of a Foreign Corporation

When you’re logged in, you’ll see that you have dozens of different state filings to choose from. To register your foreign corporation, select “Create a Business Entity” under “Other Business Entities (Corps, LLP, etc.).”

You’ll be brought to a page that asks you to choose if you want to form a domestic corporation or a foreign corporation. Make sure you select “foreign” before filling out the rest of the application.

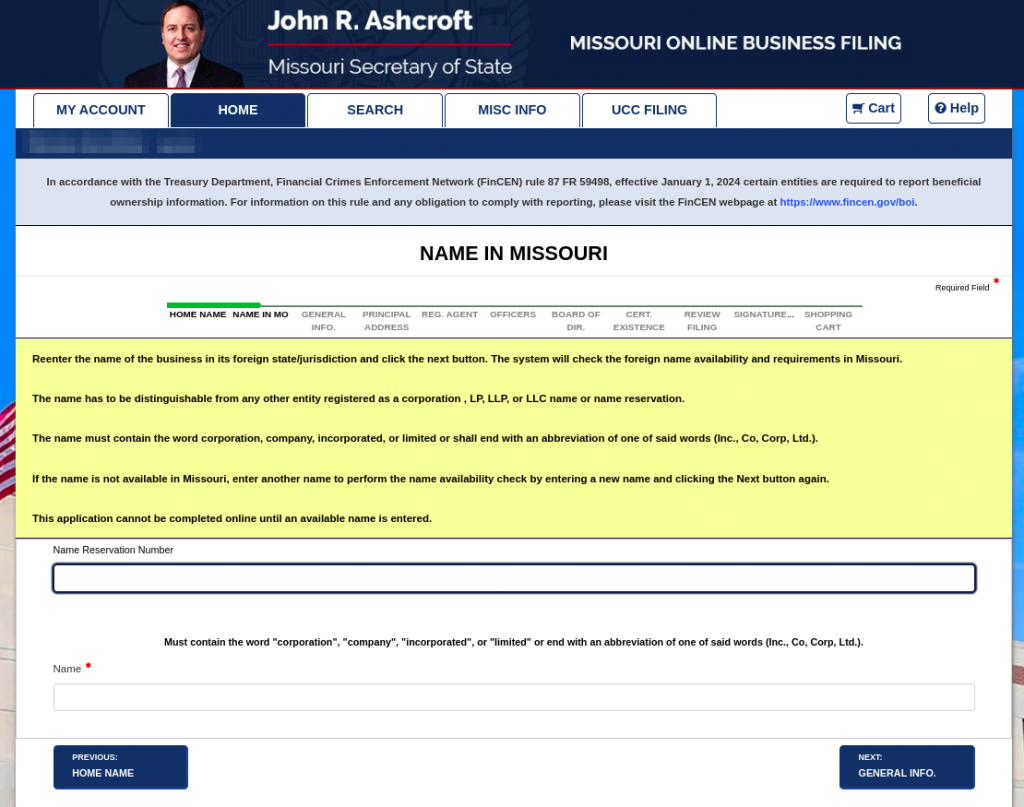

Choose a Name

You’ll need to give the name of your corporation’s home jurisdiction, as well as the name you’re going to use for your foreign corporation. If you previously reserved a name for your business, this page is where you will provide your Name Reservation Number.

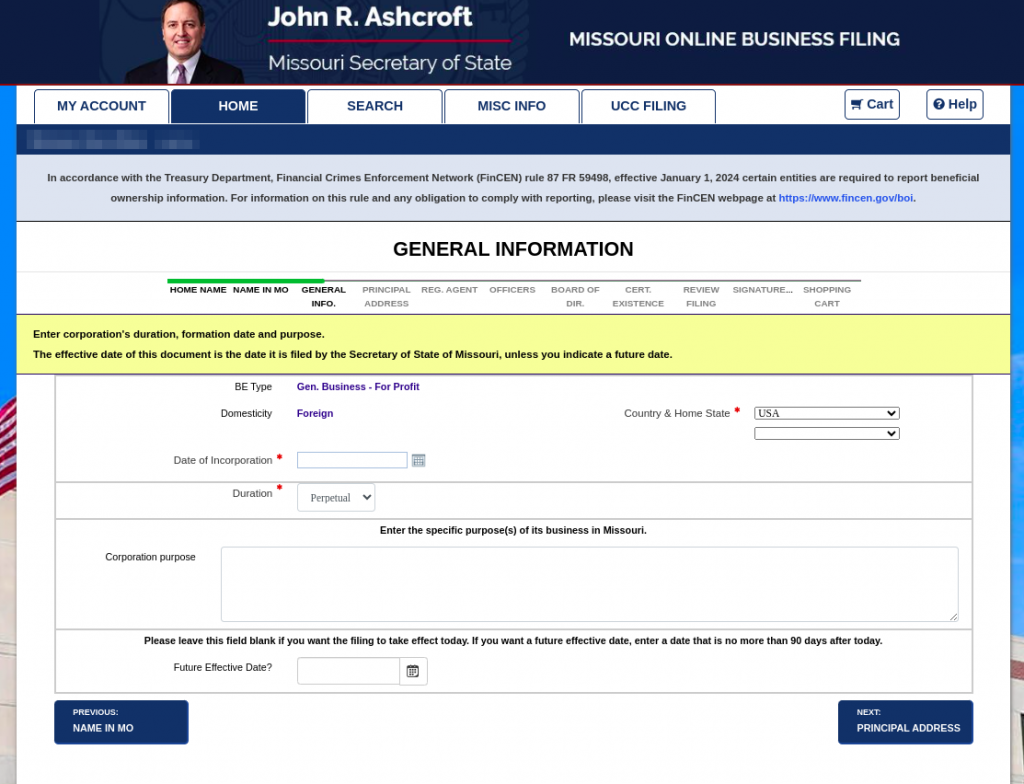

General Company Information

This step asks you for general information about your company, including your corporation’s home state, date of incorporation, its duration of operation in Missouri, and a purpose statement.

What is the purpose statement for a Foreign Corporation in Missouri?

Your company’s purpose statement can be as simple or as detailed as you’d like, just make sure the purpose of your company is clear. You’ll want to include in your statement what your company does and that you have every intention of conducting legal business in Missouri.

Principal Address

Here you’ll provide your foreign corporation’s principal address in your home jurisdiction. Unfortunately, Missouri does not allow foreign corporations to register with a PO Box as a principal address.

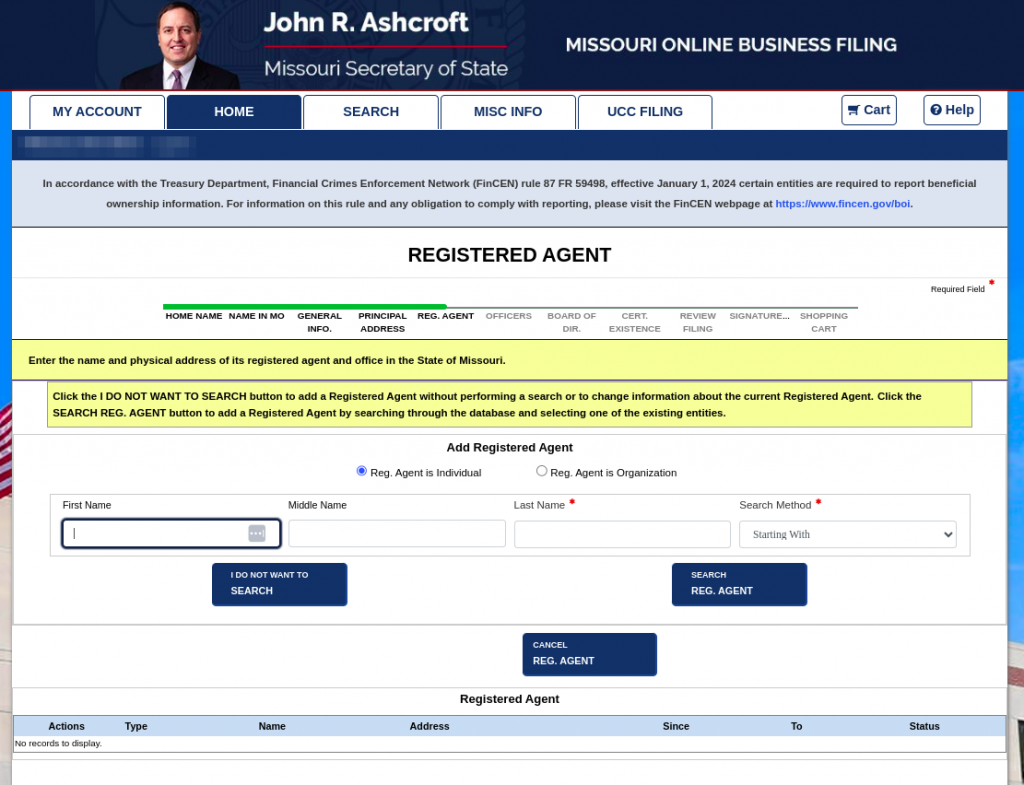

Registered Agent

Next, it’s time to provide your Missouri registered agent’s information. The online application gives you the option to look up and select a Missouri resident or the company you’ve appointed as your registered agent. You also have the option to submit this information manually.

Not sure who to appoint as your registered agent? Consider us! Missouri Registered Agent LLC has helped thousands of small business owners expand their business into Missouri by registering their foreign corporations. Our registered agent service only costs $40 a year and includes a secure online account where you can access your important documents, compliance reminders, state forms pre-filled with our registered agent information, and all the tools you need to establish your online business presence.

Registered Agent Service for Only $40/yr!

Officers and Board of Directors

The next two steps of the application require information about your corporation’s officers and Board of Directors.

Officers. You will need to indicate each officer’s role (Chairman, President, VP, etc.) and include their contact information. Make sure you submit and save the information for each officer.

Board of Directors. Similar to your corporation’s officers, you’ll also need to provide the names and contact information of each member on your Board of Directors.

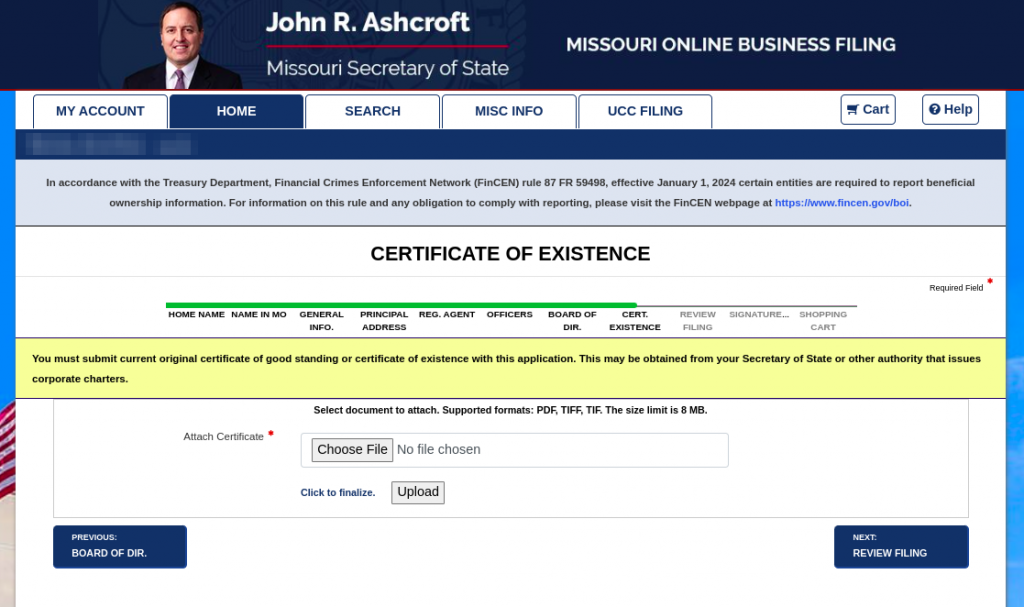

Certificate of Good Standing

Here is where you will upload your Certificate of Good Standing (sometimes also called a Certificate of Existence) from your home jurisdiction for the Missouri Secretary of State. The file you upload must a PDF, TIFF, or TIF file and no bigger than 8MB. You can upload more that one document if you need to.

Review Your Filing

Next, you’ll be taken to a page with a preview of your application. Make you review this information closely before submitting your application. You can return to the previous pages to make corrections if needed. If everything looks accurate, check the acknowledgement box at the bottom of the page before moving on to the last step.

Signatures

The last step requires a signature from one of the officers you listed on your application. Select the correct officer, check the acknowledgement box underneath, and your application is complete!

Submit Your Filing

You’ll be taken to a check out page to pay for your filing. Here, you’ll also be able to add other filings to your cart. You can also order an extra copy of your Certificate of Authority.

The online filing fee for your application is $155 plus a 2.15% processing fee for credit cards and a $0.50 fee for eChecks.

If you prefer to submit your filing by mail, you can mail or hand deliver your completed application to:

Corporations Division

PO Box 778 / 600 W. Main St., Rm. 322

Jefferson City, MO 65102

If you do this, make sure you include your form of payment (whether or check or money order) is made payable to “Secretary of State.”

If you file in person, you have more options when it comes to payment. You can pay the filing fee with a check, money order, cash, or credit card. Even if you’re paying in person, you’ll still have to pay the 2.15% processing fee for credit card transactions.

Once your payment is accepted, your Application for Certificate of Authority will be submitted to the Missouri Secretary of State.

How much does it cost to register your foreign LLC in Missouri?

About $155. This price does not include the credit card processing fee or the $0.50 eCheck fee. You can avoid this extra cost by mailing in your application, but it will take 3-4 weeks longer to get your Certificate of Authority.

5. Get your Missouri Certificate of Authority

Once your application is processed, the Missouri Secretary of State will send your foreign corporation’s Certificate of Authority in about a week. This document is what gives you permission to do business in the state of Missouri.

How long does it take to get a foreign corporation in Missouri?

This depends on how you submitted your filing. If your foreign corporation registered online, you’ll likely see your application processed and approved in 1-3 days. Paper applications can take much longer because of mailing and longer processing times, anywhere from 3 to 4 weeks.

Missouri Foreign Corporation: Things to Know

Now you know how to register your foreign corporation in Missouri, but there are a few other things to consider when doing business in the Show Me state.

Is Missouri a good state to register a foreign corporation?

Missouri is a great place do to business as a foreign corporation. With its low corporate income tax, lack of franchise tax, and cheap annual report fee, it’s easy to maintain your business. Plus, the Missouri Secretary of State’s website makes it super easy to submit and keep track of your state filings.

What are the benefits of getting a Certificate of Authority in Missouri?

-

Total privacy. The state allows foreign corporations to list their registered agent’s information on their application. After your application is accepted and your Certificate of Authority sent, it becomes public record. Keeping your information off of state documents saves you from having to deal with unending solicitors and junk mail.

-

Cheap annual report. Missouri requires both domestic and foreign corporations to file an annual report, but unlike some other states the form is simple and the filing fee is cheap ($20).

-

No annual state franchise tax. Just like Missouri domestic corporations, your Missouri foreign corporation will be required to pay the state corporate income tax of 6.25%, but no state franchise tax.

-

Fast online filing. The Missouri Secretary of State’s website really is easy to navigate. The state has made it simple to keep tabs on your state documents and compliance status. Plus, the faster filing times for submitting online won’t cost you anything extra. Other states may have fast filing times, too, but usually there’s an extra and expensive expedited fee.

Missouri Foreign Corporation FAQs

How long does a foreign corporation last in Missouri?

As long as you’d like! If you didn’t designate an end date for your business on your application (and most business owners don’t) and you file your annual report every year, your business will exist until it’s dissolved.

Is there an annual report for foreign corporations in Missouri?

All corporations in Missouri, domestic and foreign, are required to file an Annual Registration Report with the Missouri Secretary of State every year they’re in business. The report is due within 3 months after the anniversary month of when your registered your foreign corporation and costs $20 to file.

You have the option to file your annual report online or, if you prefer, by mail or delivered in person. However, the filing fee for paper filings is much higher than when you file online: $45!

Are foreign corporations subject to taxes in Missouri?

Yes. Even though Missouri axed its corporate franchise tax in 2016, domestic and foreign corporations are still required to pay the annual 6.25% corporate income tax to the Missouri Department of Revenue every year. For more information, check out the MODOR website.