A Missouri Limited Liability Company (LLC) is a type of business entity that provides limited liability protection for its owners (called members). While the process of forming a Missouri LLC might seem complicated, we’ve created this guide to walk you through everything you need to know to make your dream of owning a business in Missouri a reality.

You can avoid future headaches by hiring a professional service like Missouri Registered Agent LLC to form your Missouri LLC, or if you have the time and energy to spare, you can create your own company by following these 8 steps:

- Pick a Name

- Check if it’s Available

- Pick a Registered Agent

- Register your LLC with the State

- Pay Filing Fees

- Write an Operating Agreement

- Get an EIN

- File your BOI Report with FinCEN

Once your LLC is established and you’re ready to do business, you’ll need a website so that customers can find and contact you with ease. Our LLC formation package includes website, email, and phone services so you can look professional and keep all your business and personal communications separate.

Want to do business in Missouri, but your LLC is based in another state? All you need to do is register as a Foreign LLC in Missouri and get your Certificate of authority from the Secretary of State. We’ve written a guide for this process, too. You can find on our Missouri Foreign LLC page.

How to Start a Missouri LLC in 8 Steps

Below, we provide a step-by-step guide to DIY Missouri LLC formation. But if you’d prefer to skip the hassle, our LLC formation package includes filing with the state, a year of registered agent service, and a FREE operating agreement.

On top of getting you set up with the state, we can help you establish your online business presence and help you build your professional brand with domain name, website, email, and phone services at no additional upfront cost. Plus, unlike some other companies, our prices includes the state filing fee and you can cancel ongoing services at any time.

For $192, you get:

- LLC Filing

- Business Address

- One Year Registered Agent Service

- FREE Operating Agreement

- Domain Name, Website, Email, and Phone Services

- Lifetime Customer Service

- And More!

Order Your LLC Today!

If you’d still prefer to go it alone, read on!

Officially creating your LLC starts with filing the Missouri LLC Articles of Organization with the Missouri Secretary of State, Corporations Division. Your Missouri LLC will be official once you’ve completed the Articles of Organization, filed it with the Corporations Division, and paid the filing fee.

1. Name your MO Limited Liability Company

Choosing the right name for your Missouri LLC may not be as easy as it seems. Before filing your formation paperwork, you’ll need to choose a name that not only represents your business accurately, but also follows the state’s guidelines.

Missouri LLC Naming Requirements:

As mentioned above, the state of Missouri has requirements for what you can name your LLC. According to RSMo 347.020, the name you choose for your LLC:

- Must include a proper designator that indicates which type of business entity you’re operating: Limited Liability Company, Limited Company, LLC, LC, L.L.C. or L.C.

- Cannot include the words corporation, incorporated, limited partnership, limited liability partnership, limited liability limited partnership, Ltd, or any other abbreviation that implies your LLC is a different type of business entity.

- May not already be in use by another entity.

2. Use Missouri Business Entity Search to Lookup LLCs

The Missouri Secretary of State has made it easy to search Missouri business records and check your LLC’s name availability. Simply use the Missouri Business Lookup to search the name you’d like for your LLC using the state’s database. You’ll be able to see if any other businesses in Missouri are registered with a similar name.

Can I reserve an LLC Name?

Yes. You can reserve a name for your LLC for up to 180 days before filing your Articles of Organization. Just submit an Application for Reservation of Name to the Missouri Corporations Division and pay the $25 filing fee.

3. Choose a Registered Agent in Missouri

In order to create your Missouri LLC, you will need to appoint a Missouri Registered Agent. A registered agent is a person or company that accepts service of process on behalf of your business. Any Missouri resident can act as your registered agent as long as they are eighteen years or older, but they must be physically available to accept legal mail during regular business hours at a physical address in Missouri. (P.O. boxes and virtual offices do not count).

You can appoint yourself as your own registered agent, but that means you’ll need to include your name and address on your Articles of Organization. Keep in mind Articles of Organization become public record once they’re filed. If you’re interested in protecting your privacy, it may be beneficial to appoint a registered agent who doesn’t mind having their information “out there.”

Professional Registered Agent PROS:

Hiring a professional registered agent protects your privacy and ensures you receive all your legal mail as quickly as possible.

Professional Registered Agent CONS:

You can save money by being your own registered agent, but you’ll need to be present to accept legal during normal business hours year-round.

Is a registered agent required in Missouri?

Yes. Missouri law (RSMo 351.370) requires all businesses to appoint and maintain a registered agent. Failure to do so can result in the Secretary of State dissolving your LLC. There is also the possibility that both the LLC and its owners could be charged with additional penalties and fees.

4. Register your LLC with the Missouri Secretary of State

Once you’ve picked an available name for your LLC and appointed a registered agent, it’s time to file your Missouri LLC’s Articles of Organization. Hire a company that specializes in forming Missouri LLCs and we’ll take care of the filing for you.

Let Us Form Your Missouri LLC Today!

However, if filing on your own, we recommend filing your articles online through the Missouri filing portal, as it’s significantly cheaper ($51.25) than filing by mail ($105). We describe the online filing process step-by-step below:

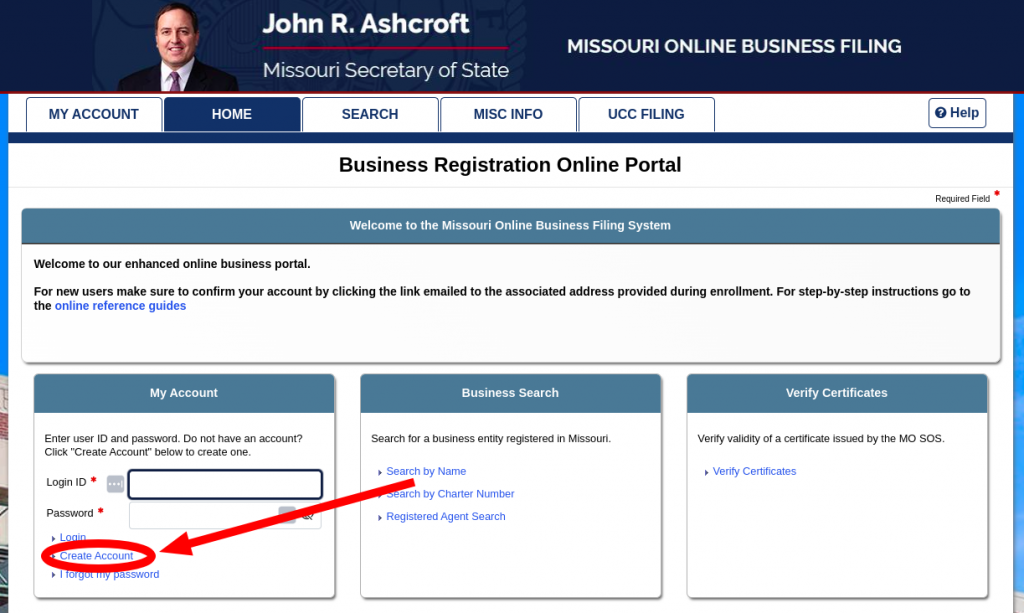

Create Account with Missouri Online Business Filing System

First, you will need to create an online account with the Corporation’s Division. You’ll see a section titled “My Account.” Inside are boxes for Login ID and Password. Below, you’ll want to select “Create Account.” This will take you to an Online Account Creation form.

You will need to provide information like a User ID, password, security questions, as well as your name, address, and contact information. Check the box at the bottom of the page to agree to the terms and conditions and voila! You now have an online account.

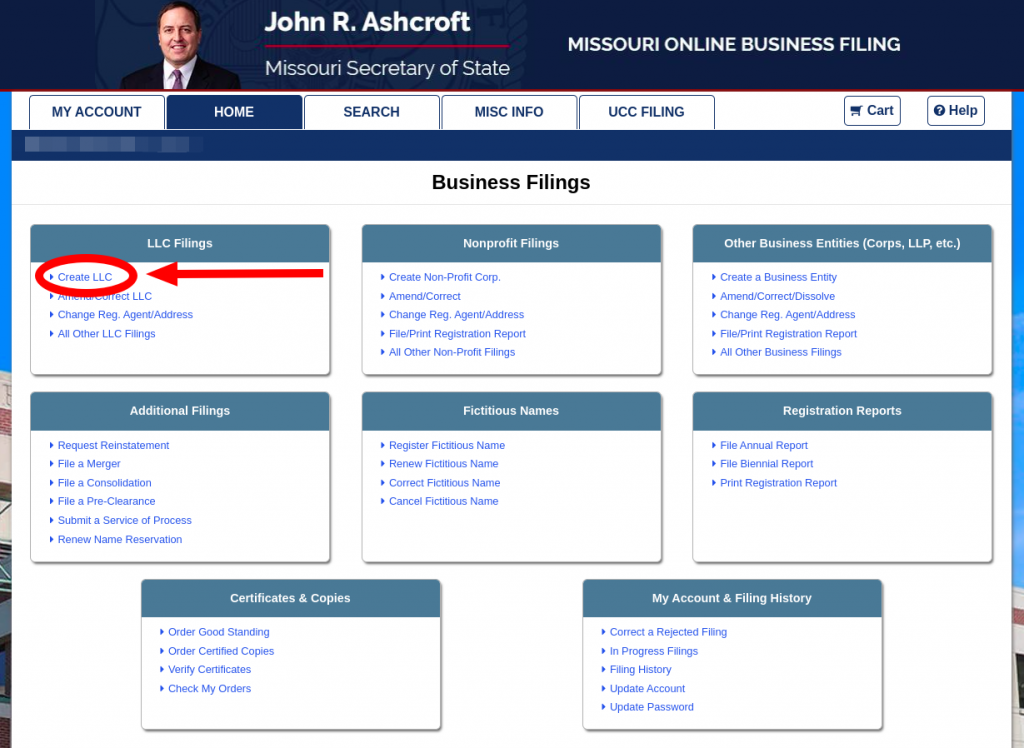

Start an LLC Filing and Complete Missouri Articles of Organization

Once you are logged into your account, you will have dozens of filings to choose from. Make sure you select “Create LLC” under “LLC Filings.”

This will bring you to a page that will ask you to confirm that you want to form an LLC and whether or not your LLC is domestic or foreign. Select “domestic” to create a Missouri LLC.

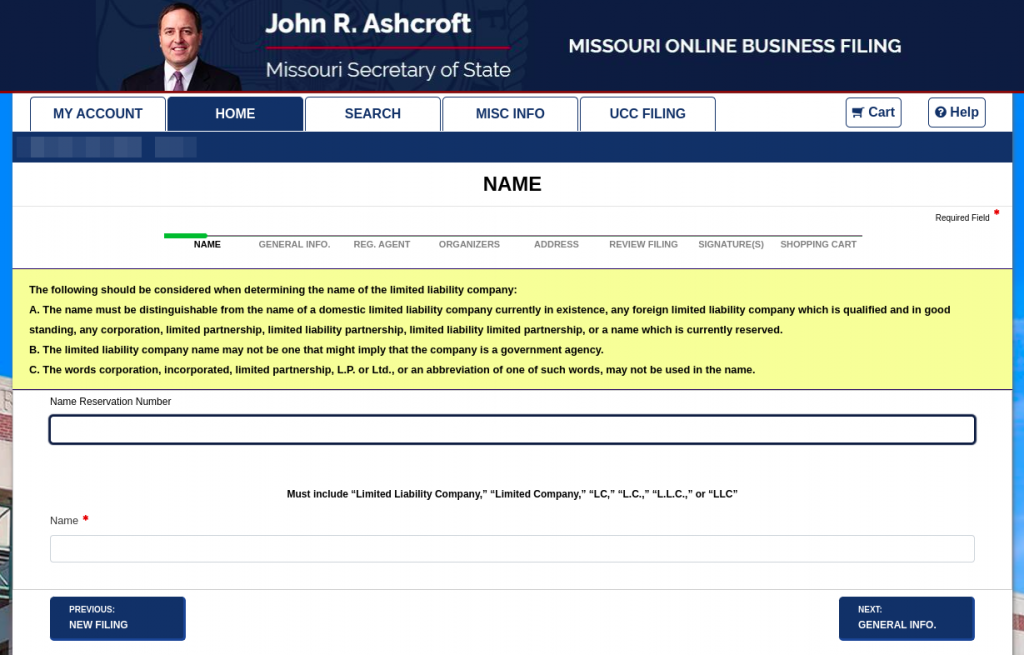

Name:

Provide the name of your Missouri LLC here. If you’ve already reserved a name, make sure to include your Name Reservation Number, too. Once submitted, you’re ready to move onto the next page.

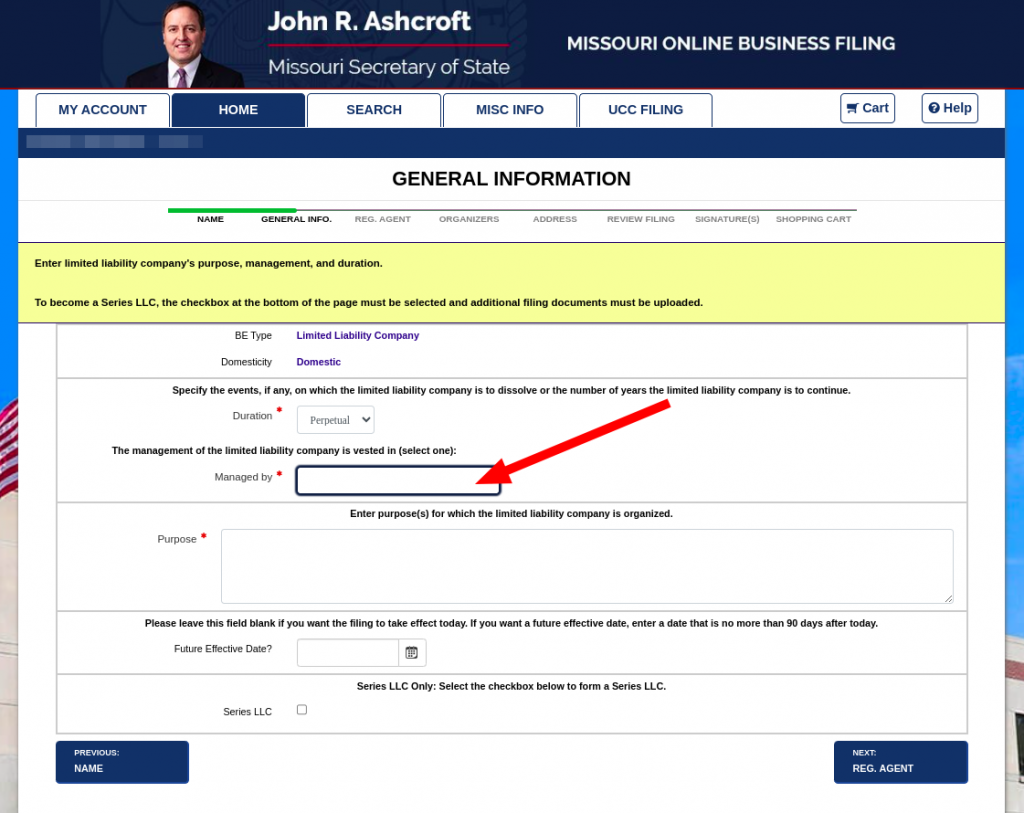

Duration:

The next page of your articles asks for general information about your company, including the duration of your business. Here, you’ll have the opportunity to choose between several different options:

- Freeform: your LLC will dissolve upon the occurrence of a specific event.

- Perpetual: your LLC will exist until dissolution paperwork is filed.

- Date: your LLC will dissolve on a specific date.

LLC Managers and/or Members:

Select whether your Missouri LLC will be member-managed or manager-managed.

Purpose:

Next, the form will ask for your Missouri LLC’s purpose. You can include your purpose statement in the box underneath your management structure.

What is the purpose statement for an LLC in Missouri?

A purpose statement for an LLC in Missouri can be as simple or as detailed as you’d like, but it should clearly explains the purpose for your LLC. You want to make it clear what your company is doing and that your intention is to do it legally under Missouri law.

For example, if you are opening a T-Shirt printing company, your purpose statement might read something like, “The purpose of Show Me the Shirts LLC is to print, sell, and distribute custom T-shirts. Show Me the Shirts LLC will conduct and operate lawful business activities legally allowed in the state of Missouri.”

Future Effective Date:

If you’d like to schedule when your LLC will be active you have the option to delay the effective date of formation. If you don’t choose a date (and most LLCs do not), your business will be active as soon as your application is processed by the Corporation’s Division.

Missouri Series LLC:

You also have the option to designate your new LLC as a series LLC. This choice is optional, and you should only check this box if the LLC you’re forming will be a series to an already-established parent LLC.

What is a series LLC in Missouri?

A Missouri Series LLC is a limited liability company with established divisions called “series.” Each of these series has its own limited liability protection. A Missouri Series LLC is a good option for business owners looking to hold individual business under a single parent LLC, while keeping the limited liability intact for each series.

A Missouri Series LLC is created by filing Articles of Organization with the Corporation’s Division, as well as Missouri Form LLC 1A. This form is also available to file in your online account with the Secretary of State.

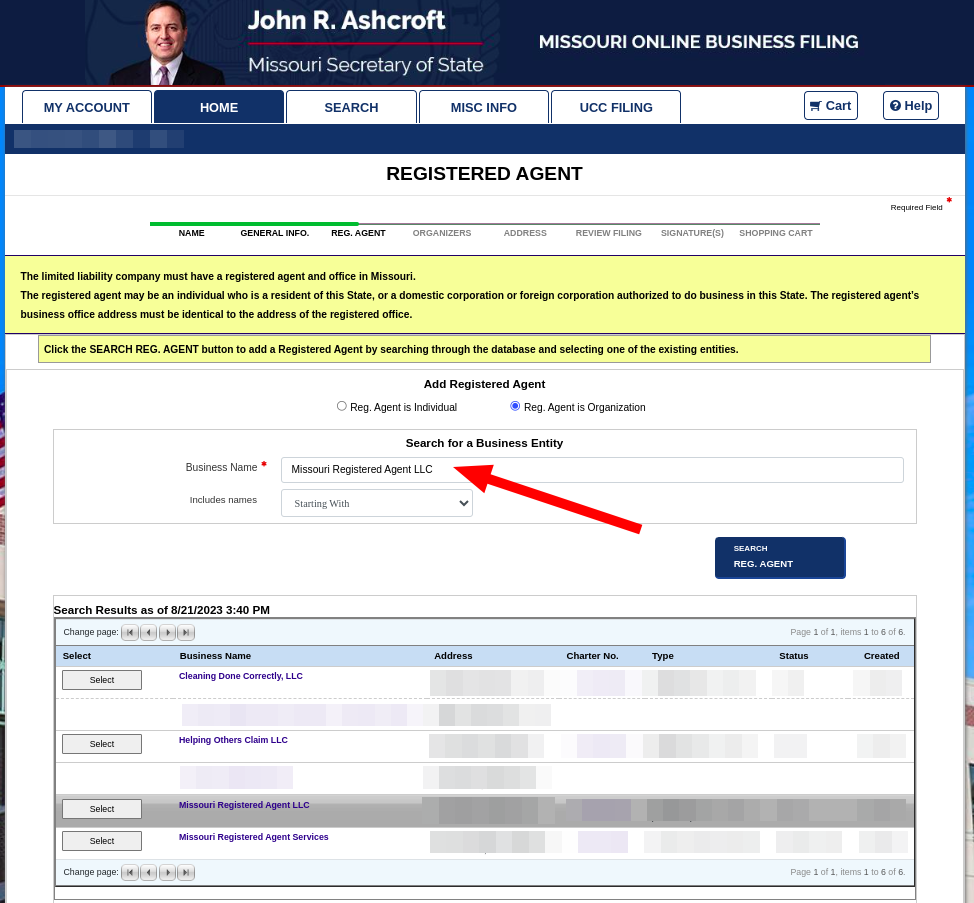

Add or Search MO Registered Agents:

Once you complete the General Information page of your application, you will be directed to a page requesting your registered agent’s information. Whether you’ve appointed an individual or an organization to be your registered agent, you will have the option to search their name. Once you’ve found them in the system, the state will also provide the agent’s address.

Organizers:

Your Missouri LLC will need to list at least one organizer on your Articles of Organization. The organizer of your LLC will be the person (or people if more than one) who sign your articles. You can list up to 5 organizers. Your organizers don’t need to be member or managers of your LLC, but whomever is listed must also provide the following personal information on your Articles of Organization:

- Whether the organizer is an individual or an organization

- The organizer’s name

- The organizer’s address (cannot be a P.O. Box or virtual office address)

Principal Office Address:

Next, you’ll need to list the address of your Missouri LLC’s principal place of business. This must be a physical address where your business operates.

Can you use a PO box for Missouri LLC?

No. The state of Missouri does not allow businesses to list a P.O. box or virtual office address as its principal office. It has to be a physical address.

Review Filing:

Once you have completed the other pages of the application, you will come to a page where you can review your filing. Here, you’ll be able to review the information you’ve submitted for your articles. If any of the information you previously provided is incorrect or needs to be changed, you can easily visit previous pages and edit the information. You also have the option to save your filing and return to it later.

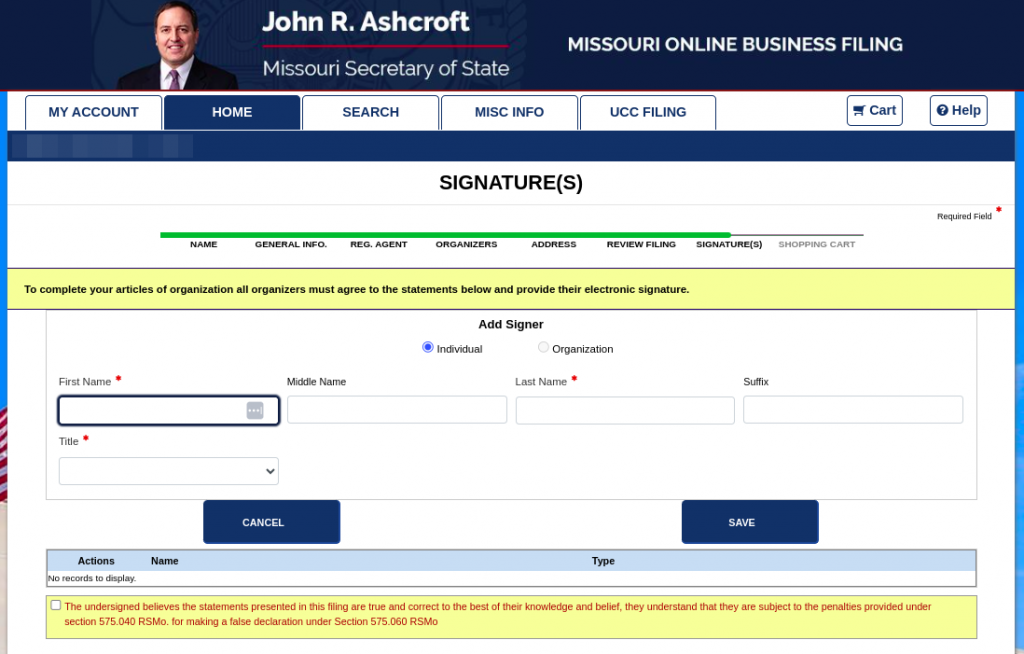

Signature(s)

After you’ve reviewed your filing and it’s ready to go, you will need to provide signatures for your organizers. On the SIGNATURE(S) page of the form, you will select “Add signer” and enter the name, title, and signature for each of your Missouri LLC’s organizers. You will “sign” your articles by checking the box at the bottom of the page.

Submit your Filing Order

The last step is to pay for your filing and submit your order! You will have the option to modify your order, remove the filing from your cart, or delete it all together. Here, you also have the option to add another filing and order certified copies of your Articles of Organization.

You will pay the $50 filing fee (+ $1.25 processing fee) in your account. You can pay for your Articles of Organization with a credit card or electronic check.

How long does it take to get an LLC in Missouri?

5. Pay Missouri LLC Cost and Fees

The cost of creating a Missouri LLC depends on the method you use to file your Articles of Organization. The Corporation’s Division charges more for paper applications than those submitted online. Plus, online applications are processed faster (within 1 to 3 business days), whereas it can take up to 6 weeks to process your mailed in application. If you’re going to submit your articles yourself, we recommend doing it online.

If you are creating a series LLC, Missouri is a great place to do it. It’s one of the few states in the country that doesn’t charge extra to form a series LLC. All you need to do is pay the Missouri LLC filing fee for each series you register with the state.

How much does an LLC cost in Missouri?

At least $51.25. The state of Missouri prefers online applications and charges more if you submit articles on paper.

- Paper applications, either mailed in or delivered in person, cost $105 to file.

- Online applications cost $50 to file, plus that $1.25 filing fee.

6. Complete a Missouri LLC Operating Agreement

After you’ve filed your Articles of Organization, you’ll want to create an operating agreement for your Missouri LLC. As a legal document, the operating agreement establishes the structure, rules, and procedures of your Missouri LLC. Unlike your articles, your company’s operating agreement is not filed with the state. Instead, it’s an internal document used only by your LLC.

However, just because an operating agreement is kept internal doesn’t mean your LLC won’t need one. RSMo 347.081 requires all LLCs to keep an operating agreement. While the agreement can be written or oral, we highly recommend creating a written operating agreement. Having your LLC’s members adopt and sign a written operating agreement establishes proof that everyone involved in your company is on the same page. Should any disputes between members happen in the future, your operating agreement will be a useful document to keep things on track.

A good operating agreement addresses:

- Company structure (single member, multi-member, or manager-managed LLC)

- Classes or groups of members and managers

- Decision-making powers and voting rights

- Who has authorization to execute articles or notices

- Transfer of members’ interest

- How members and managers are compensated

- Company gain, deduction, loss, and credit

- LLC’s tax election and who is authorized to make those elections

7. Get a Tax ID (EIN) from the IRS

If you plan on hiring employees, you will need to apply for an employer identification number (also called an EIN or FEIN) for your LLC. An EIN is basically a social security number for your company that you will use to identify your LLC on tax returns. You will also need an EIN to open a business bank account and apply for business licenses and permits.

How do I get an EIN number in Missouri?

The state of Missouri does not issue EINs, but the IRS does. You can get an EIN by completing an Application for EIN Tax ID Number and filing it with the IRS. The form is free to file and takes just a couple of minutes to complete.

- If you file for an EIN online you’ll be able to get one immediately.

- If you mail in a paper application, it will take about 4 weeks to get your EIN from the IRS.

How much does it cost to get an EIN number in Missouri?

Nothing! The filing to get an EIN from the IRS is free.

Do Missouri LLCs expire?

The short answer is no. Unless you specified a dissolution date on your Articles of Organization, your LLC will exist as long as it remains compliant in the state of Missouri. However, there are rare cases where Missouri will dissolve your business. For example, if you fail to list a registered agent or list an agent who is not available to accept service of process, the state may choose to dissolve your LLC.

Unlike some other states, Missouri does not require Missouri LLCs to file an annual report. In some states, failure to file this report can lead to dissolution. Luckily, the Show Me state isn’t one of them!

8. File your BOI Report with FinCEN

After you form your LLC with the state, you will need to file a Beneficial Ownership Information (BOI) Report with the Financial Crime Enforcement Network, or FinCEN. Your report will include basic information about your business. FinCEN also requires businesses to provide personal information about each of the company’s beneficial owners and company applicants: legal names, dates of birth, residential addresses, and photo ID. This information will not be made available to the public, and failure to report could lead to fines and even jail time. When your report is due depends on when you formed your LLC:

LLCs formed before 2024: Due by January 1, 2025

LLCs formed in 2024: Due within 90 days of formation

LLCs formed in 2025 or after: Due within 30 days of formation

Want to avoid adding another filing to your plate? Let our local experts take care of your BOI Report for you. You can add our BOI Report Filing for just $25.

Missouri LLC Benefits

We’ve walked you through how to form your Missouri LLC, but there are a few other things you should know about forming and operating an LLC in Missouri.

Is Missouri a good state for an LLC?

Missouri is a great place for an LLC! The Missouri Secretary of State has made it really easy to keep track of your business’s filings online. Plus, the fees to start and maintain your LLC are some of the cheapest in the country. And because you aren’t required to list the names of all of your members and managers on your Articles of Organization, Missouri is an ideal place to start a business for those looking to keep their personal information private.

What are the benefits of an LLC in Missouri?

Starting an LLC in Missouri comes with its benefits:

- Total privacy.Unlike other states, Missouri does not require the names of an LLC’s members or managers on state paperwork. LLCs are required to list their organizer’s information, though. This means if a member or manager chooses to act as an organizer, they still have to provide their personal information. Luckily, you can appoint or hire an organizer (like us!) who will include their personal information on your filing so you don’t have to. Why is this important? After your LLC is formed, the paperwork you file with the state becomes public record. Keeping your personal information private means you can maintain your privacy and avoid things like unscrupulous lawsuits or incessant calls from telemarketers.

- No annual report. Almost every other state in the Union requires annual reporting from business entities, but not Missouri! There are no annual reporting requirements or state filing fees for LLCs, which makes a Missouri LLC a far cheaper option than forming an LLC in another state.

- No annual state franchise tax. Unlike Missouri corporations, Missouri LLCs are not required to pay an annual franchise tax to the state. As long as your LLC keeps its default tax status, your business will be exempt from paying the Missouri state franchise tax.

- Fast and cheap online filing. The Missouri Secretary of State has made it easy to form your business entirely online, and the state can process your filing within 1 to 3 business days. Many states also offer fast filing times, but they usually come with an exorbitant fee for expedited service. If you file online, your LLC can be created in just a day. It’s also much cheaper than filing by paper, which costs a whopping $105!

What is the disadvantage of a Missouri LLC?

There are some rare cases where a Missouri LLC will be dissolved because of a member’s death or if the LLC itself declares bankruptcy. Another potential problem is the ability for the LLC to collect funding (a.k.a. investments). Potential investors may feel uncomfortable with the lack of a traditional corporate business structure, so if you’re looking to garner outside investment, it might be a little trickier to get funding than if you were doing so for a corporation.

Missouri LLC FAQs

How long is an LLC good for in Missouri?

For as long as you’d like it to be. Unless you indicated a dissolution date or freeform event on your Articles of Organization, your LLC will last until you choose to dissolve it. Plus, LLCs in Missouri aren’t required to file an annual report or pay an annual fee, which means that’s one less due date and expense your business will need to keep track of.

Is there an annual fee for LLC in Missouri?

Nope! Missouri LLCs are not required to pay an annual fee to file an annual report, nor are they required to pay any annual franchise taxes. Once you’ve filed your articles with the state, you’re good to go until you decide to dissolve your company.

What do LLCs need to file taxes in Missouri?

Unless your LLC has opted to be taxed as a corporation, your LLC does not need to file taxes in Missouri. Instead, the company’s profits “pass through” to its members, who then report this income on their personal tax returns. The members are then responsible to pay the federal 15.3% self-employment tax and the 4.95% Missouri income tax.

How much does an LLC pay in taxes in Missouri?

Missouri LLCs do not pay taxes in Missouri. An LLC’s members and employees will need to pay taxes on the income they receive from the company, but the company itself is not required to file taxes.

$192 Total - Done in 6 Minutes